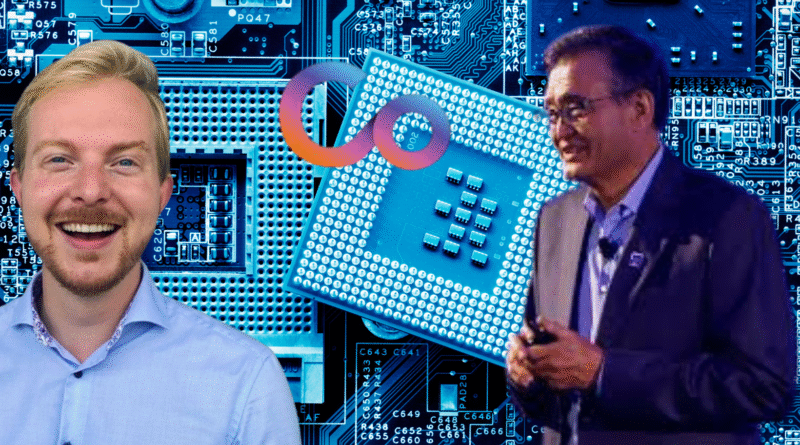

Corintis Raises $24M for Chip-Cooling Tech; Intel CEO Joins Board

Swiss startup Corintis, which develops advanced microchannel liquid cooling for semiconductor chips, has raised $24 million in Series A funding and announced that Intel CEO Lip-Bu Tan will join its board of directors. The move underscores the increasing strategic importance of thermal management in next-generation AI hardware.

Why This Matters

As AI workloads and data center compute demands escalate, conventional cooling approaches (air cooling, surface liquid cooling) are nearing their limits. High-power chips—especially GPUs and AI accelerators—generate intense localized heat, threatening performance, reliability, and energy efficiency. Corintis’s technology, which channels coolant through micro-scale channels embedded within chips, addresses this “thermal bottleneck” more effectively.

Microsoft, a Corintis customer, tested the system and observed that it cooled more than three times better than typical state-of-the-art cooling systems.

Corintis Company & Funding

| Category | Details |

|---|---|

| Company Name | Corintis SA |

| Headquarters | Lausanne, Switzerland |

| Founded | 2019 |

| Industry | Semiconductor Cooling Technology / AI Infrastructure |

| Core Technology | Liquid microchannel cooling integrated into chips (microfluidic cold plates) |

| Products & Services | – Microchannel Cooling Modules (Cold Plates): Scalable to 1M units/year – Co-Packaged Cooling Solutions: Integrated directly into chips – Simulation & Design Software: Co-optimized cooling with chip architecture – Custom Cooling Systems for AI accelerators & HPC |

| Market Focus | AI data centers, cloud providers, semiconductor manufacturers, high-performance computing (HPC), telecom |

| Market Size (Est.) | – Global Data Center Cooling Market: $20.3B in 2024, projected to reach $45.7B by 2030 (CAGR ~14%) – AI Chip Market: $80B in 2025, expected to surpass $190B by 2030 |

| Current Customers | Microsoft (validation partner), data center operators, semiconductor firms |

| Employees | ~55 (2025), expanding to ~70 by year-end |

| Production Capacity | ~100,000 cold plates annually; targeting 1 million by 2026 |

💰 Funding History

| Round | Amount Raised | Date | Lead Investors | Other Investors / Notes |

|---|---|---|---|---|

| Pre-Seed / Seed | ~$9.4M (est.) | 2020–2023 | Early-stage Swiss/European VCs | Initial R&D & prototyping |

| Series A | $24M | Sep 2025 | BlueYard Capital | Founderful, Acequia Capital, Celsius Industries, XTX Ventures, others |

| Total Funding | ~$33.4M | 2019–2025 | – | Includes pre-seed and Series A |

👤 Leadership & Board

| Name | Role | Background |

|---|---|---|

| David Knox | Co-Founder & CEO | Engineer with experience in microfluidics, thermal systems, scaling advanced cooling solutions |

| Geoff Lyon | Board Member | Founder & former CEO of CoolIT Systems, expertise in liquid cooling for data centers |

| Lip-Bu Tan | Board Member (also Intel CEO) | Veteran semiconductor executive, investor, founder of Walden International, previously Cadence CEO, joined Intel as CEO in 2025 |

| Core Team | ~55 engineers & specialists | Expertise in microfabrication, thermodynamics, semiconductor design |

🏢 Key Investors

| Investor | Type | Notes |

|---|---|---|

| BlueYard Capital | Lead Investor (Series A) | European VC focused on frontier technologies |

| Founderful | VC | Backed scaling stage |

| Acequia Capital | Venture Fund | Focus on early-stage disruptive startups |

| Celsius Industries | Strategic Investor | Thermal technology expertise |

| XTX Ventures | VC arm of XTX Markets | Fintech + deeptech investments |

| Lip-Bu Tan | Individual / Strategic | Invested personally before becoming Intel CEO |

Funding Round & Investors

- The $24M Series A round was led by BlueYard Capital, with participation from Founderful, Acequia Capital, Celsius Industries, XTX Ventures, among others.

- This brings Corintis’s total funding to ~$33.4M (including pre-seed rounds).

- The funding will help scale manufacturing, expand the team, and open U.S. operations to better serve its American customers.

Leadership & Board Update

Corintis has added two significant industry names to its board:

- Lip-Bu Tan, CEO of Intel (appointed earlier in 2025), is joining as a board director. He also invested personally in Corintis prior to his Intel appointment.

- Geoff Lyon, founder and former CEO of CoolIT (a thermal management company), also joins the board.

Tan commented:

“Cooling is one of the biggest challenges for next-generation chips. Corintis is fast becoming the industry leader in advanced semiconductor cooling solutions to address the thermal bottleneck.”

Technology & Scaling Plans

Corintis’s core innovation is co-designed microfluidic cooling: using simulation and optimization software along with microchannel fabrication, the cooling architecture is tailored to each chip’s internal heat profile.

The system can function either as a drop-in upgrade for existing liquid cooling systems or be integrated directly into chips (“co-packaged cooling”) for better thermal performance and efficiency.

Corintis currently produces about 100,000 cold plates (microfluidic cooling modules) annually, and aims to ramp up to 1 million units per year by 2026.

They plan to grow their headcount from ~55 to ~70 by year-end and open U.S. offices to support deployment in American data centers.

Strategic Implications

- Thermal becomes a design frontier

As chip power densities rise, thermal management ceases to be a secondary issue and becomes a core design constraint. Corintis’s approach is emblematic of cooling being integrated into chip architecture rather than layered on afterward. - Validation from Microsoft and Intel

Microsoft’s threefold improvement benchmark gives credibility. Meanwhile, Intel CEO’s board appointment signals that even large incumbents see cooling as an essential frontier in the semiconductor stack. - Potential for broader applications

Beyond AI/data centers, advanced cooling techniques will be vital in high-performance computing (HPC), telecom, edge data centers, and possibly consumer spaces as compute density increases. - Ecosystem synergy and risk

Having insiders like Tan and Lyon on board may help align Corintis with semiconductor roadmaps and smooth partnerships. But it also places pressure on execution — scaling microfluidic cooling at chip volumes is nontrivial.

Outlook & Challenges

- Manufacturing scale: Achieving high yield, fine tolerances, and reliability in mass producing microchannel cold plates will be a key test.

- Adoption hurdle: Convincing chip makers and data centers to integrate or retrofit new cooling schemes requires compatibility, risk mitigation, and ROI demonstration.

- Water & energy efficiency: Corintis claims lower water consumption and energy use versus legacy cooling systems — critical points in sustainability-conscious markets.

- Competition & IP landscape: Other startups and giants are also exploring liquid cooling, vapor chambers, and novel thermal materials. Protecting IP and differentiating performance will be important.

If Corintis can deliver on its scaling goals and maintain performance advantages, it could become a foundational technology enabler in the AI infrastructure stack.

✅ FAQs

What is Corintis and what does it do?

Corintis is a Swiss startup that develops advanced liquid microchannel cooling technology for chips, addressing the thermal bottleneck in AI, data centers, and high-performance computing.

How much funding did Corintis raise in 2025?

Corintis raised $24 million in a Series A round, bringing its total funding to around $33.4 million.

Who invested in Corintis’s $24M Series A round?

The round was led by BlueYard Capital, with participation from Founderful, Acequia Capital, Celsius Industries, XTX Ventures, and others.

Why did Intel CEO Lip-Bu Tan join Corintis’s board?

Lip-Bu Tan, who personally invested in Corintis prior to becoming Intel’s CEO, joined the board to support its mission of solving the critical thermal bottleneck in next-gen chips.

What makes Corintis’s cooling technology unique?

Its microchannel liquid cooling is integrated directly into chips, enabling up to 3x better performance than current state-of-the-art cooling methods, as validated by Microsoft.

What are Corintis’s expansion plans after this funding?

Corintis plans to scale production from 100,000 cold plates annually to 1 million by 2026, expand its team, and open U.S. offices to support American data center customers.

Why is chip cooling important for AI and data centers?

AI chips become more powerful, they generate intense heat that traditional cooling cannot manage efficiently. Advanced liquid cooling improves performance, reliability, and energy efficiency, making it crucial for next-gen computing.

Conclusion

Corintis’s $24M raise and the strategic board addition of Intel’s CEO mark a significant inflection point in the semiconductor cooling space. As AI workloads intensify, managing heat will no longer be a back-end concern — it will be a frontier of performance, efficiency, and competitiveness. Corintis is betting its microfluidic cooling approach is a key part of the solution.

Keep Reading:

- Modular Raises $250M to Take On Nvidia — What It Means for AI Infrastructure

- PhonePe IPO: Walmart‑backed fintech eyes ₹12,000 crore — full analysis, company profile, funding, business model, financials, future plans and investor summary

- Singapore’s Richest 2025 Revealed: Top 20 Billionaires & Net Worths

- Erika Kirk: From Beauty Queen to Conservative Powerhouse

- Chakr Innovation Secures $23 Million in Series C: A Turning Point for India’s Deeptech Clean-Tech Sector