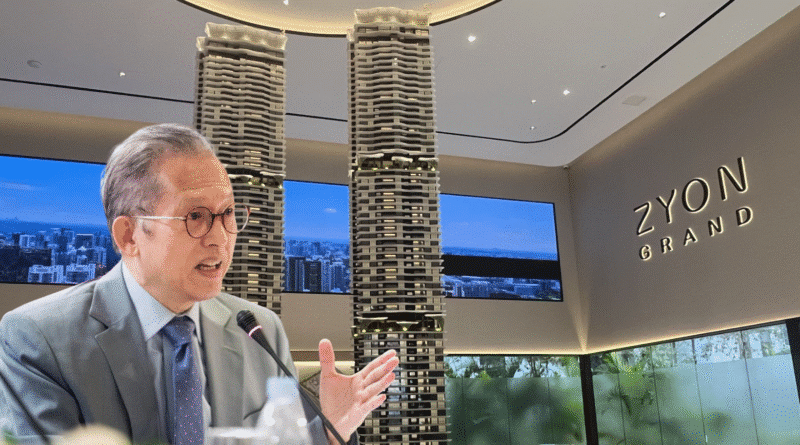

Billionaire Kwek Leng Beng’s CDL Sells 84% of Zyon Grand Towers as Singapore Market Heats Up

Singapore, October 2025 — In one of the strongest launches of the year, City Developments Limited (CDL), controlled by billionaire Kwek Leng Beng, announced it sold 590 of 706 units (84%) at its new Zyon Grand Towers during launch weekend.

The development achieved an impressive average selling price (ASP) of S$3,050 per square foot (psf) — marking a milestone moment for Singapore’s resilient property market.

Zyon Grand by the Numbers

- Project: Zyon Grand — twin 62-storey luxury residential towers

- Developer: City Developments Limited (CDL) & Mitsui Fudosan (Asia)

- Total units launched: 706

- Units sold (as of launch weekend): 590 (84%)

- Average Selling Price: S$3,050 psf

- Entry price: 1-bedroom + study from S$1.298 million

- Penthouse sale: One five-bedroom penthouse sold for over S$10 million

“We are heartened by the overwhelming response to Zyon Grand. The strong sales reflect sustained confidence in Singapore’s real estate market,” CDL said in its press release.

Why Buyers Rushed In

1. Prime Integrated Development

Zyon Grand forms part of the larger Zyon Galleria mixed-use development — featuring F&B outlets, a supermarket, childcare center, and serviced apartments. The convenience and lifestyle appeal strongly attracted both owner-occupiers and investors.

2. Direct MRT Connectivity

The project enjoys a direct link to Havelock MRT station (Thomson–East Coast Line) — a major factor behind its popularity. Easy access to the CBD and Orchard area further boosted its desirability.

3. Competitive Pricing for River Valley

Despite being a prime central location, the pricing of S$3,050 psf remains competitive compared to neighboring developments. This balance of luxury and value helped drive rapid take-up.

Who Bought the Units

According to CDL’s launch data:

- 84% of buyers were Singapore citizens

- 14% were Permanent Residents

- 2% were foreigners, primarily from China, India, Malaysia, Indonesia, South Korea, and Japan

This indicates robust local demand — even with higher stamp duties for foreign buyers still in place.

Singapore’s Property Market Outlook

Data from the Urban Redevelopment Authority (URA) shows that private residential property prices rose 0.9% quarter-on-quarter in Q3 2025.

The number of new private homes sold also climbed, driven by successful high-end launches like Zyon Grand.

Analysts say the results demonstrate strong liquidity and continued appetite for well-located, high-quality projects — especially those with integrated amenities and transport connectivity.

CDL’s Corporate Context

CDL, one of Singapore’s largest property developers, has had an eventful year. Earlier in 2025, founder and chairman Kwek Leng Beng made headlines during a temporary boardroom dispute that was later resolved amicably with CEO Sherman Kwek.

The blockbuster Zyon Grand launch reaffirms CDL’s leadership position in the market — both in execution and investor confidence.

Analyst Takeaway

“Zyon Grand’s performance highlights that even in a measured growth phase, prime launches in strategic locations continue to see outsized success,” says property analyst Tan Hwee Ling.

With land scarcity, infrastructure growth, and sustained investor confidence, Singapore’s property sector looks poised to remain resilient and premium-priced heading into 2026.

Conclusion

The 84% sell-out success of Zyon Grand underscores two truths about Singapore’s real estate:

- Prime properties remain in high demand despite cautious policy environments, and

- Developers with strategic timing and integrated designs continue to capture strong market sentiment.

As 2025 closes, CDL’s Zyon Grand sets a new benchmark for luxury developments in Singapore’s city core — blending location, lifestyle, and investor confidence into a standout launch.

Pingback: Taiwan’s Foxconn To Invest Up To $1.4 Billion In AI Data-Center Equipment — What It Means - The Founders Magazine