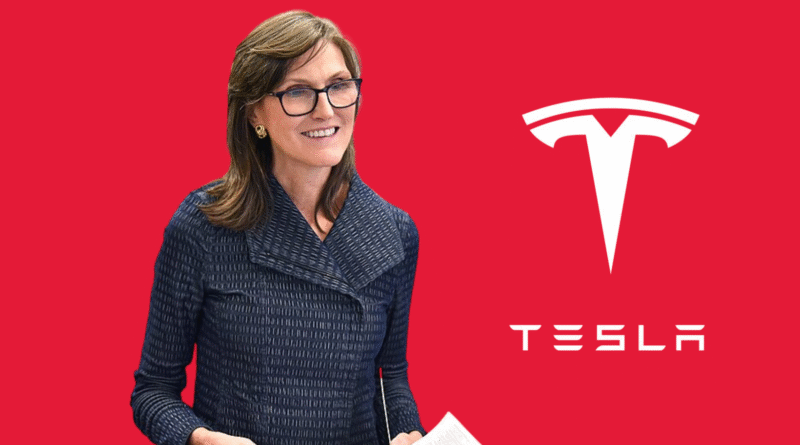

How Cathie Wood Beat Wall Street by Betting Tesla Is Worth More Than $1 Trillion

Cathie Wood, the visionary founder and CEO of ARK Invest, has long been a staunch advocate for Tesla, Inc. (NASDAQ: TSLA). While many on Wall Street were skeptical, Wood’s unwavering belief in Tesla’s transformative potential has not only proven critics wrong but has also positioned her firm at the forefront of innovative investing. This article delves into how Wood’s bold predictions and strategic investments have reshaped perceptions of Tesla’s value, culminating in a market capitalization exceeding $1 trillion.

Comprehensive summary of Cathie Wood’s Tesla bet and ARK Invest strategy

| Category | Details |

|---|---|

| Investor | Cathie Wood |

| Firm | ARK Invest |

| Primary ETF Holding Tesla | ARK Innovation ETF (ARKK) |

| Tesla Investment % of Fund | ~10% of total assets |

| Current Tesla Stock Price | $431.89 (as of Sep 26, 2025) |

| ARK’s Tesla Price Target (2029) | $2,600 per share |

| Revenue Projection (2029) | $1.2 trillion |

| Key Growth Drivers | – Autonomous driving & ride-hailing – AI and robotics integration – Energy storage and Tesla Insurance |

| Strategic Moves | Purchased 115,000 Tesla shares in July 2025 before Q2 earnings |

| Market Cap Milestone | $1 trillion+ |

| Investment Philosophy | Focus on disruptive innovation and long-term growth potential, beyond short-term market sentiment |

| Risk Approach | High conviction, long-term holding despite Wall Street skepticism |

| Performance Validation | Tesla exceeded market expectations in revenue, production, and tech innovation, validating ARK’s forecasts |

| Assets Under Management (ARK Invest) | $20 billion+ (2025) |

| Analyst Sentiment | Wall Street was initially skeptical; now some analysts align with bullish targets |

| Case Study Insight | Wood’s Monte Carlo simulation model incorporates multiple growth scenarios (bear, base, bull) to estimate Tesla’s future stock price |

| Key Takeaway | Visionary investing in disruptive tech can yield outsized returns even against conventional market wisdom |

Tesla Growth Drivers & Projected Revenue Contribution by 2029

| Segment | Projected Revenue Contribution ($ Trillion) |

|---|---|

| Autonomous Ride-Hailing | 0.45 |

| AI & Robotics | 0.30 |

| Energy Storage & Solar | 0.25 |

| EV Sales | 0.15 |

| Insurance & Services | 0.05 |

| Total | 1.2 |

🚘 Tesla’s Journey to a $1 Trillion Valuation

Tesla’s ascent to a $1 trillion market capitalization was a monumental milestone in the automotive and tech industries. As of September 26, 2025, Tesla’s stock price stands at $431.89, reflecting investor confidence in its future prospects.

ARK Invest’s bullish projections have been a cornerstone of this narrative. In 2025, ARK maintained a long-term price target of $2,600 per share for Tesla by 2029, emphasizing the company’s potential to revolutionize transportation through autonomous vehicles and AI-driven services.

📈 ARK Invest’s Strategic Moves

ARK Invest’s commitment to Tesla is evident in its investment strategy. In July 2025, ahead of Tesla’s Q2 earnings report, ARK disclosed purchases of over 115,000 Tesla shares across two of its ETFs. This move underscored their confidence in Tesla’s future growth, even amidst short-term market fluctuations.

Tesla remains the largest holding in ARK’s Innovation ETF, accounting for nearly 10% of the fund’s assets, highlighting the firm’s strong conviction in Tesla’s long-term value.

🔮 The Vision for the Future

Wood’s vision extends beyond electric vehicles. She views Tesla as the world’s largest AI project, integrating robotics, energy storage, and autonomous driving technologies. ARK’s projections suggest that by 2029, Tesla could generate $1.2 trillion in revenue, with autonomous ride-hailing services contributing significantly to this growth.

This forward-thinking approach has positioned ARK Invest as a leader in identifying and capitalizing on disruptive technologies, with Tesla at the center of this strategy.

🏆 Beating Wall Street Expectations

While traditional analysts were cautious, if not skeptical, of Tesla’s valuation, ARK Invest’s bold predictions have largely been validated by the company’s performance. Tesla’s ability to innovate and execute on its vision has not only met but, in many cases, exceeded expectations, reaffirming Wood’s investment philosophy.

ARK’s success with Tesla has also contributed to the firm’s growth, with assets under management exceeding $20 billion as of 2025.

📊 ARK’s Tesla Valuation Model

ARK Invest employs a Monte Carlo simulation model to estimate Tesla’s future stock price. As of June 2024, the expected value for Tesla’s stock in 2029 is $2,600 per share, with bear and bull cases ranging between $2,000 and $3,100 per share.

The model incorporates various factors, including vehicle autonomy, energy storage, and AI integration, to project Tesla’s potential market share and revenue streams.

🔍 Frequently Asked Questions (FAQs)

What is ARK Invest’s price target for Tesla?

ARK Invest’s price target for Tesla is $2,600 per share by 2029, based on their Monte Carlo simulation model.

How does ARK Invest view Tesla’s future?

ARK Invest views Tesla as more than just an electric vehicle manufacturer. They consider Tesla a leader in AI, robotics, and autonomous driving, with significant potential in energy storage and insurance services.

What factors contribute to Tesla’s valuation?

Key factors contributing to Tesla’s valuation include advancements in AI and full self-driving technologies, expansion of autonomous ride-hailing services, and growth in energy storage solutions.

How has Tesla’s stock performed recently?

As of September 26, 2025, Tesla’s stock price is $431.89, reflecting a 30% increase over the past three months.

What is the outlook for Tesla’s stock?

Analysts have raised their price targets for Tesla, with some projecting a $600 price target by early 2026, driven by advancements in AI, autonomy, and robotics.

💡 Conclusion

Cathie Wood’s bet on Tesla’s potential has reshaped the investment landscape, demonstrating the value of visionary thinking and a commitment to disruptive innovation. By maintaining a steadfast belief in Tesla’s future, even when faced with skepticism, Wood has not only achieved significant financial success but has also influenced the broader investment community’s approach to emerging technologies.

Keep Reading:

- Tether Eyes $15–$20B Private Raise at $500B Valuation — Full Analysis

- Corintis Raises $24M for Chip-Cooling Tech; Intel CEO Joins Board

- Modular Raises $250M to Take On Nvidia — What It Means for AI Infrastructure

- PhonePe IPO: Walmart‑backed fintech eyes ₹12,000 crore — full analysis, company profile, funding, business model, financials, future plans and investor summary

- Singapore’s Richest 2025 Revealed: Top 20 Billionaires & Net Worths